In today's fast-paced dynamic business landscape, streamlining payment processing is crucial for achieving growth. By adopting efficient and reliable payment solutions, businesses can minimize operational costs, improve customer satisfaction, and ultimately, fuel expansion.

- Efficient payment processing enables businesses to process transactions quickly, reducing wait times and improving the overall customer experience.

- Secure payment gateways protect sensitive customer data, building trust and confidence in your brand.

- Implementing with multiple payment methods offers greater flexibility and convenience for customers.

By focusing on a seamless and secure payment process, businesses can unlock new opportunities for growth and thrive in the competitive market.

Reliable and Streamlined Payment Gateways: A Comprehensive Guide

In today's digital landscape, secure and efficient payment gateways are essential for any online business. A reliable gateway ensures smooth transactions while protecting sensitive customer data from malicious activity. This comprehensive guide will delve into the crucial aspects of payment gateways, guiding you in choosing the best solution for your requirements.

We'll explore popular providers, analyze their features and fees, and provide practical tips for maximizing security and efficiency. Whether you're a startup, understanding the intricacies of payment gateways is vital to your success in the online marketplace.

Let's begin on this journey to navigate the world of secure and efficient payment gateways.

Enhancing Payment Flows for a Seamless Customer Experience

In today's rapidly evolving digital landscape, providing a frictionless customer experience is paramount. One crucial aspect that often determines customer satisfaction is the payment process. By optimizing payment flows, businesses can remarkably improve their overall performance. A well-designed payment system should be easy to navigate, allowing customers to make transactions quickly and securely. Moreover, offering a variety of payment options can meet the diverse needs of your target audience. This not only boosts convenience but also decreases cart abandonment rates.

Unlocking Revenue Potential with Cutting-Edge Payment Solutions

In today's dynamic market landscape, businesses need to embrace the latest payment solutions to enhance their revenue potential. Modern payment technologies offer a frictionless checkout experience for customers, leading to higher conversion rates and reduced cart abandonment.

Implementing innovative payment methods such as mobile wallets, contactless payments, and subscription-based can substantially improve customer satisfaction and accelerate revenue growth. By offering get more info a diverse selection of payment options, businesses can cater the needs of a broader customer base and unlock new revenue streams.

The Future of Payment Processing: Innovations and Trends

The financial landscape is on the brink of significant transformation, with innovations constantly reshaping how we handle financial exchanges. copyright integration is poised to revolutionize traditional transaction infrastructures, offering enhanced transparency. Furthermore, the rise of mobile wallets is accelerating a shift towards seamless money transfers. As consumers demand faster payment options, businesses must adapt these advancements to remain viable in the evolving market.

- Artificial Intelligence (AI) is playing an increasingly crucial role in fraud detection and risk management, improving the security of payment transactions.

- Facial recognition offers a more secure and convenient way to authorize payments.

- Third-party access is enabling new payment services, promoting innovation in the industry.

On the horizon| the payments landscape is set for continued growth. With ongoing advancements in security, we can expect a more accessible payment ecosystem that serves consumers and businesses alike.

Mitigating Fraud Risk in the Online Payments Landscape

The digital payments industry is a dynamic and ever-evolving space, offering unparalleled convenience and efficiency for both consumers and businesses. However, this rapid growth creates significant challenges, particularly concerning fraud risk. Cybercriminals are constantly developing innovative methods to exploit vulnerabilities in the payment ecosystem, seeking to steal sensitive information and execute financial crimes. To combat these threats effectively, it is crucial for stakeholders to implement robust mitigation strategies that address the multifaceted nature of fraud risk.

A comprehensive approach to fraud prevention should encompass a range of measures. These include: adopting multi-factor authentication, conducting thorough customer due diligence, employing advanced analytics and machine learning algorithms to detect suspicious activity, and fostering collaboration between financial institutions, payment processors, and law enforcement agencies.

By prioritizing fraud risk mitigation, stakeholders can strengthen the security of the digital payments ecosystem, protecting both consumers and businesses from the devastating consequences of fraud.

Jennifer Grey Then & Now!

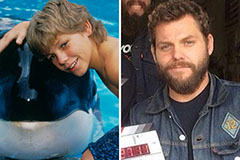

Jennifer Grey Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!